CONNECT WITH US

Take the first step towards a brighter financial future by booking a consultation with us. Fill out the form below, and one of our specialists will reach out to you shortly. Let’s discuss your credit goals and how we can help you achieve them. Your journey to better credit starts here!

STEP ONE

Sign Up & Pick a Package:

Start your journey by signing up and choosing the package that fits your needs. This is your entry point to access our premium financial repair services. 🎯

Assessment & Registration:

Once you’ve picked your package, we’ll schedule a personalized assessment and get you registered. This gives you exclusive access to our member portal, where all the magic happens! ✨ Our team will guide you through our comprehensive online tools to make sure you’re getting the most out of our services.

Onboarding & Financial Report Review:

After onboarding, you’ll have full access to your portal, and our experts will dive into your financial report. 🔍 We’ll thoroughly review your reports to spot any errors or inaccuracies. From there, we’ll work diligently to dispute and resolve each issue, helping to improve your financial standing and put you on the path to success! 💪

STEP TWO

-

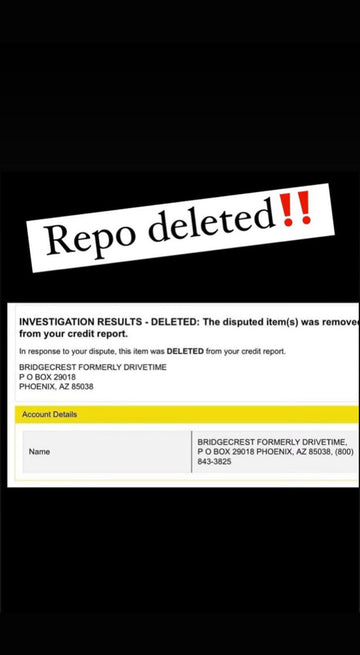

Dispute Process

1.Mailing Dispute Letters:

Note:\\ If you’ve seen fast results on TikTok promising deletions in 7 days, that’s not what we do. We don't offer credit sweeps, file false identity theft reports, or engage in any illegal practices. For identity theft cases**, please contact Syed Hussian, Esq at sh@haseeblegal.com.

2.Response Time:

A) Stall Letters: If you receive a stall letter, know it’s illegal and a violation of your rights under the FCRA. There’s no law preventing you from using a third-party service like ours. Due to fraud in the industry, credit bureaus often send stall letters to avoid the cost of investigations.

B) No Response**: If they don’t respond, you can choose to resend the letter via certified mail for $7. If they still don’t respond, we’ll forward your case to an attorney. It's well-documented that credit bureaus discard millions of disputes annually without investigating (source: CFPB.gov).

C) FCRA Violations**: If the bureaus violate the FCRA, your case will be referred to an attorney.

3.Round 2 Disputes:

The next set of dispute letters will be tailored to the response (or lack of response) from Equifax, Experian, and TransUnion.

4.Building Credit:

Once disputes are handled, we will review potential strategies to help you rebuild and strengthen your credit.

*Important: We are not attorneys and cannot provide legal advice.

STEP THREE

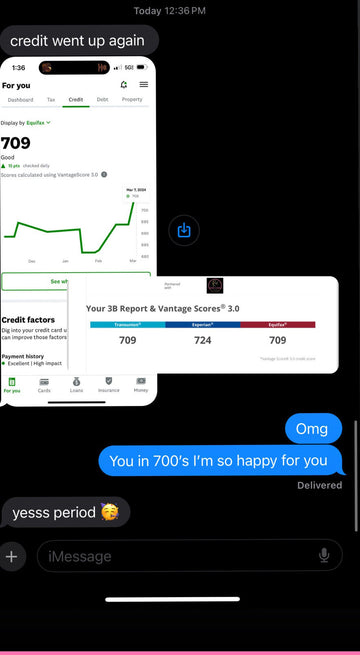

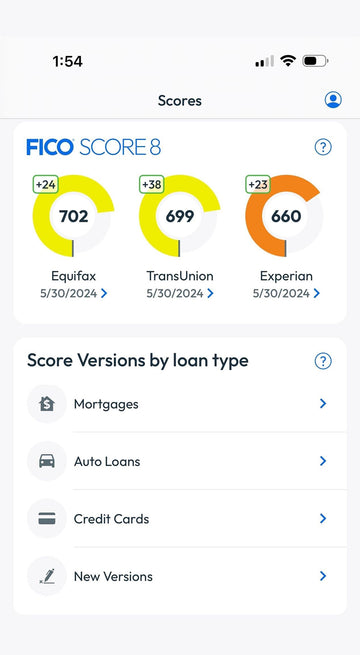

Enhanced Financial Standing: The final stage is perhaps the most gratifying: observe as your financial standing improves! Our suite of online tracking tools empowers you to witness the removal of inaccurate information from your reports. Even following the resolution of disputes, our online resources enable us to keep a vigilant eye on your financial health, ensuring the accuracy of any newly added information. These tools assist you in making prudent decisions that will continue to positively impact your financial future. Guiding you through the dispute process marks just the initial phase of our commitment. We aim to remain steadfastly by your side, ensuring the establishment of a resilient financial foundation moving forward.

WHAT WE OFFER?

FINANCIAL CHECKUP

Our Financial Checkup Service provides you with a comprehensive evaluation of your financial health. We analyze your credit reports, assess your income and expenses, and review your debt and savings. Based on our findings, we create a personalized action plan to help you improve your credit score, reduce debt, and achieve your financial goals. With expert guidance and ongoing support, we ensure you have the tools and knowledge to maintain financial stability and make informed decisions for a secure future.

VIRTUAL TAX FILING

Our Virtual Tax Filing consultation service offers you the personalized attention and expertise needed to navigate your tax obligations from the comfort of your own home. Meet with our knowledgeable tax professionals virtually, who will ensure that your taxes are accurately prepared and filed, giving you peace of mind and maximizing your returns. Enjoy a hassle-free tax season with tailored advice and support, all conducted virtually for your convenience.

REAL ESTATE SERVICES

Our Financial Checkup Service provides you with a comprehensive evaluation of your financial health. We analyze your credit reports, assess your income and expenses, and review your debt and savings. Based on our findings, we create a personalized action plan to help you improve your credit score, reduce debt, and achieve your financial goals. With expert guidance and ongoing support, we ensure you have the tools and knowledge to maintain financial stability and make informed decisions for a secure future.

SCORE RESTORATION SERVICES

Our Financial Checkup Service provides you with a comprehensive evaluation of your financial health. We analyze your credit reports, assess your income and expenses, and review your debt and savings. Based on our findings, we create a personalized action plan to help you improve your credit score, reduce debt, and achieve your financial goals. With expert guidance and ongoing support, we ensure you have the tools and knowledge to maintain financial stability and make informed decisions for a secure future.

FEATURED PRODUCTS

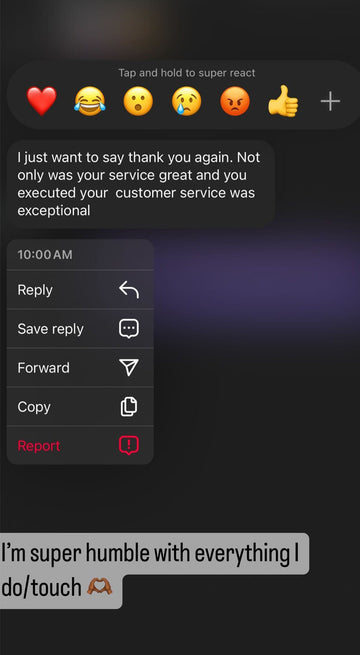

TESTIMONIALS